Cannabis Safe Harbor Bill Making Traction

Thursday, March 28th marked the date the House Financial Services Committee adopted the H.R. 1595, the Secure and Fair Enforcement Banking Act of 2019 on a 45-15 vote. This bill would warrant access to financial services for cannabis-related authentic businesses and service providers.

You can read more about the issues related to marijuana related real estate transactions here.

According to Wesley McClelland, vice president of federal government relations at the American Property Casualty Insurance Association in Washington, “A good first step to ensuring the needed clarity for insurers that wish to provide financial services in states that have legalized marijuana. While the bill does not address all the potential transactions that our industry is compelled by states to provide to individuals and businesses, we hope to continue working with the bill sponsors and supporters to address the larger set of issues that insurers face as more states look to legalize marijuana.” His statement was highlighted in an article published by Business Insurance (https://www.businessinsurance.com/article/20190328/NEWS06/912327571?template=printart).

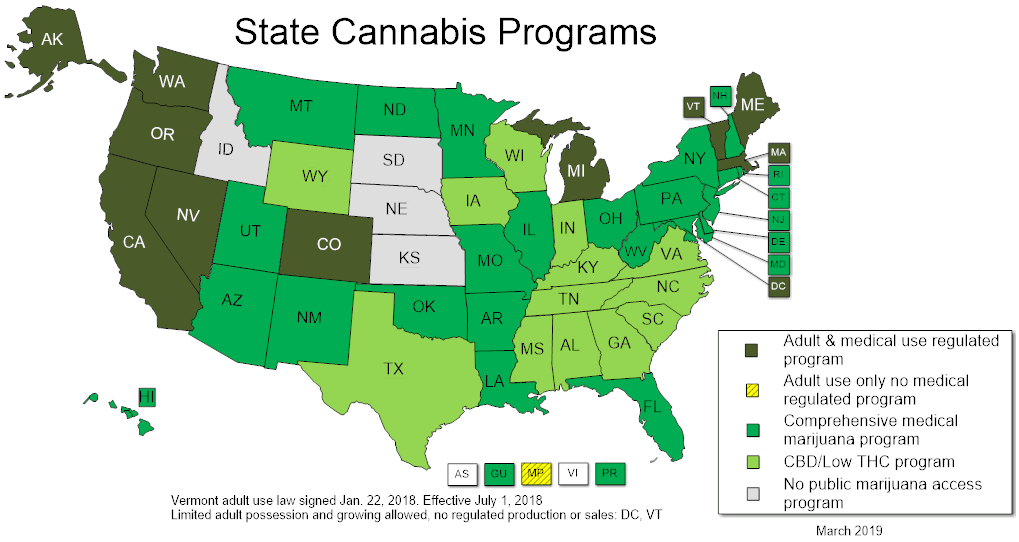

This has been a very hot topic in the state of Michigan since it passed public vote in November of last year. The United States is broken down into four categories regarding the legalization of marijuana as shown in the map below which was provided by https://disa.com/map-of-marijuana-legality-by-state : 1) Fully Legal; 2) Medical Marijuana Legal only; 3) CBD/Low THC Program; 4)Fully Illegal. There are only 18 states left in the great United States of America that are fully illegal when it comes to marijuana. With that said, the passing of this bill onto to the next stage is catching several eyes in the financial world and insurance industry.

It may seem to us that this topic started off backwards by passing the legalization of marijuana and now attempting to protect financial institutions and other industries that may have a direct impact. However, at least some ground work is being done to protect insurers and banks to allow working with legal cannabis states.